infoteo.ru

Tools

Pet Funeral Insurance

Available exclusively for Members, the CANA Professional Liability Insurance Program is a policy primarily for crematories – both human and animal. Valuable and in-demand insurance industry-wide statistical data for various lines of business, including auto, home, health and life insurance. Financial. Most pet insurance providers cover euthanasia for humane reasons. However, accident-only pet insurance plans might cover euthanasia only if it's deemed. Pets Best pet insurance plans for dogs and cats can cover unexpected accidents, illnesses, surgeries, cancer, and much more. For a typically low monthly fee, pet health insurance helps to reimburse you for a portion of your vet bills, helping you pay for your dog or cat's unexpected. With 1 in 3 pets needing unexpected emergency veterinary treatments each year,1 pet insurance is an affordable way to be prepared. Get one step closer to. Pet insurance coverage varies from plan to plan, and cremation isn't likely to be covered under most major policies. Your veterinarian can help you determine how to deal with end-of-life pet decisions for your four-legged family member. The hardest part of pet ownership is saying goodbye to your companion. Learn more about pet burial or cremation services, and be ready when the time comes. Available exclusively for Members, the CANA Professional Liability Insurance Program is a policy primarily for crematories – both human and animal. Valuable and in-demand insurance industry-wide statistical data for various lines of business, including auto, home, health and life insurance. Financial. Most pet insurance providers cover euthanasia for humane reasons. However, accident-only pet insurance plans might cover euthanasia only if it's deemed. Pets Best pet insurance plans for dogs and cats can cover unexpected accidents, illnesses, surgeries, cancer, and much more. For a typically low monthly fee, pet health insurance helps to reimburse you for a portion of your vet bills, helping you pay for your dog or cat's unexpected. With 1 in 3 pets needing unexpected emergency veterinary treatments each year,1 pet insurance is an affordable way to be prepared. Get one step closer to. Pet insurance coverage varies from plan to plan, and cremation isn't likely to be covered under most major policies. Your veterinarian can help you determine how to deal with end-of-life pet decisions for your four-legged family member. The hardest part of pet ownership is saying goodbye to your companion. Learn more about pet burial or cremation services, and be ready when the time comes.

For a few extra dollars a month, this add-on could help cover the costs of euthanasia and cremation, or help pay for commemorative items like an urn, framed. A pet health insurance policy reimburses the pet owner for specified veterinary care. As with your health insurance policy, these policies typically itemize. Planning your funeral arrangements in advance can offer you and your family a number of benefits: Emotional Benefits, Financial Benefits. You can claim up to €3,~ in veterinary fees for 12 months, plus much more. Complete pet cover | Pet Insurance | An Post Insurance. Premier Plus. Ideal for. First, it may help cover the high cost of funeral and burial expenses for your pet. It might also replace any future income that your pet may have generated. In. Life insurance for dogs. Pet life insurance policies provide reimbursement for the pet's value in the event it disappears or gets stolen, as well as replacement. Pet Memorials and More Though not covered by our Accident and Illness plan, our optional Wellness Rewards plan reimburses for memorial items and costs. Premier Private Cremation · Your Pet will have his/her own True Tracking Tag with identification number throughout the removal and cremation to insure integrity. Lifetime pet insurance is the most extensive pet insurance cover you can get for your cat or dog. As long as you keep renewing your policy, it'll last for. Fetch Pet Insurance does not cover the cost of pet cremation in the unfortunate event that your cat or dog passes away. iconhome /Pet Ownership & Adoption/Pet Ownership/Pet Owner Topics/The Cost of Pet Burial Products underwritten by Veterinary Pet Insurance Company (CA). Pet insurance takes the worry out of vet bills, so you can focus on getting your pet the care they deserve. You can count on these benefits to help keep. Pet Cemeteries | Monthly Payment Finance Programs For Pets | We ease the burden of up-front payments for Pet Services and Pet Cemetery costs. What Does Pet Insurance Cover? · Emergency & Hospitalization · Surgeries · Veterinary Specialists · Hereditary & Congenital Conditions · Chronic Conditions · Dental. We understand what a heartbreaking situation this is, so our policies do cover euthanasia when recommended by a licensed veterinarian. What is pet euthanasia? The Pet Funeral Ceremony · Prayers and Blessings for a Pet Funeral. Depending on your religious beliefs, an appropriate prayer of blessing may be included. Valuable and in-demand insurance industry-wide statistical data for various lines of business, including auto, home, health and life insurance. Financial. What you're covered for. Our cover helps with the cost of cremation or cemetery burial for your pet. It pays out if they died or were put to sleep by a vet. I understand that some places have Pet Life Insurance for working animals and/or animals who bring in money but I was wondering about just covering the cost.

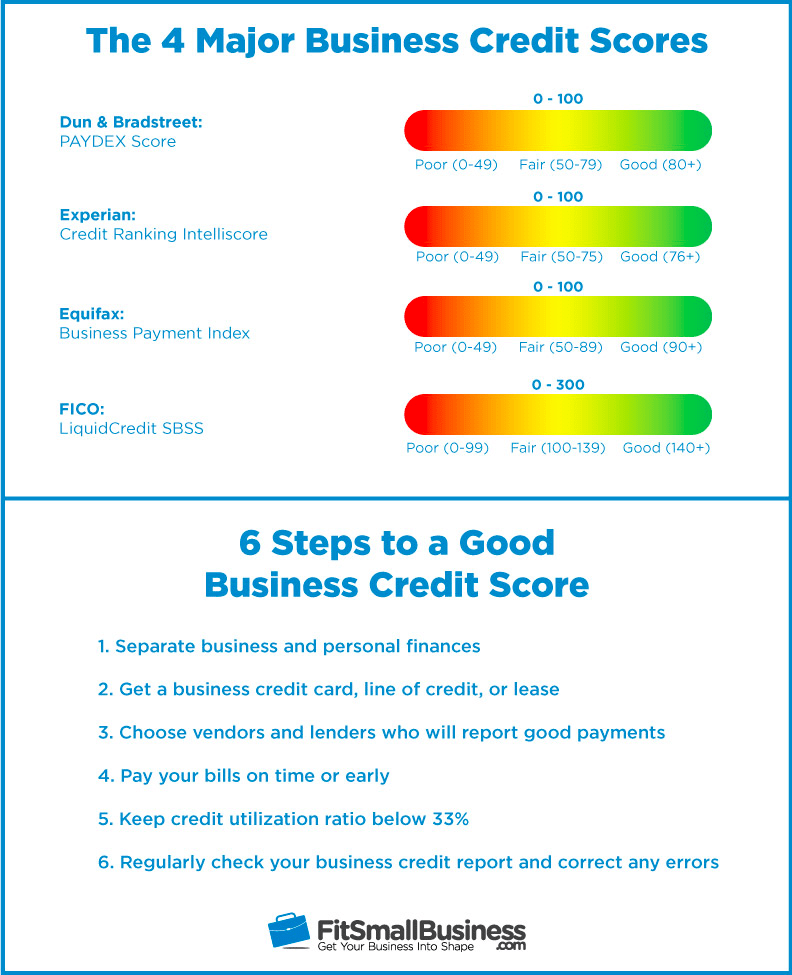

Corporate Card Credit Score

With a few exceptions, Business card accounts do not appear on your personal credit reports, and therefore have no role in calculation of your credit scores. However, unlike credit scores that range from to , business scores are graded on a scale of 1 to Common Ways How Business Credit Affects Your. If you're an authorized user of a corporate credit card with a large company, using the card is unlikely to have much effect on your personal credit. Corporate business credit cards are generally reserved for businesses that generate more than $4 million annually. Corporate cards tend to have higher credit. If you use your business credit card responsibly and are consistently making timely payments, you may not see any impact to your personal credit score. Experian uses a scale of for their business credit scores. A score between 80 and deems the business a low risk, is a medium risk and is. If you didn't give your SS# and it doesn't land on your personal credit reports, it cannot impact your personal credit scores. Corporate credit cards of various types are issued to individual employees in the name of the firm, while others are granted to the company. A score of means that your business is perceived to be at Low Moderate Risk. Business credit and personal credit are two different things. A good personal. With a few exceptions, Business card accounts do not appear on your personal credit reports, and therefore have no role in calculation of your credit scores. However, unlike credit scores that range from to , business scores are graded on a scale of 1 to Common Ways How Business Credit Affects Your. If you're an authorized user of a corporate credit card with a large company, using the card is unlikely to have much effect on your personal credit. Corporate business credit cards are generally reserved for businesses that generate more than $4 million annually. Corporate cards tend to have higher credit. If you use your business credit card responsibly and are consistently making timely payments, you may not see any impact to your personal credit score. Experian uses a scale of for their business credit scores. A score between 80 and deems the business a low risk, is a medium risk and is. If you didn't give your SS# and it doesn't land on your personal credit reports, it cannot impact your personal credit scores. Corporate credit cards of various types are issued to individual employees in the name of the firm, while others are granted to the company. A score of means that your business is perceived to be at Low Moderate Risk. Business credit and personal credit are two different things. A good personal.

FICO is the most commonly used method of scoring personal credit. There is no equivalent for businesses; each commercial credit bureau scores and reports its. It doesn't! The Expensify Card will never have an impact on your personal credit score. How does Expensify protect us from fraud? Cardholders can suspend their. The reason your personal credit score matters is because the credit issuer wants reassurance that if your business fails, you'll be able to meet the debt. Some business credit cards report only negative information to personal credit bureaus, such as late payments. Corporate credit card issuers with corporate liability generally won't check each employee's credit, and such cards won't affect employee credit scores for. If you're an authorized user of a corporate credit card with a large company, using the card is unlikely to have much effect on your personal credit. Business credit scores are different from personal credit scores, but function in a similar way—to indicate how likely you are to pay back borrowed funds. Just. Brex is a corporate credit card that's built to help businesses scale. Get x higher limits with built-in spend controls—and industry-leading rewards. Typically credit card companies offering business credit cards will be looking for a credit score of or higher. Remember that using your business card can. That said, most business lenders and credit card issuers see your personal credit score as an indicator of your overall financial responsibility. Business. A business credit card is a credit card that allows business owners or authorized employees to pay for company expenses, from office supplies and utility bills. Now that we see how important business credit scores are, let's define them: A business credit score is a number, representing the likelihood your business will. Commercial Credit Card Program · Cards for Large Corporations · Manage your Does a business credit card affect my personal credit score? No, your. Like personal credit scores, a business credit score is a numerical measure representing a business's creditworthiness, but the scale is 0 to Three major. Your business credit score measures your company's credit worthiness and offers insight into the financial health of your company. Your business credit score is. Predictive risk scores that predict the health of a company over the next 12 months. Industry and financial trade data including credit payment and financial. Keep's corporate card has higher credit limits, the highest cash back rewards on the market, and absolutely no fees. Apply with no impact to your credit score. A business credit score numerically represents an organization's creditworthiness based on its financial history. A third-party credit bureau calculates this. Many organizations check business credit to evaluate a company's financial stability. Your credit score could determine loan approval and interest rates. The Stripe Corporate Card is the easiest way for everyone in your company to handle expenses. Instantly provision cards and manage your company's spending in.

Purchase Loan Calculator

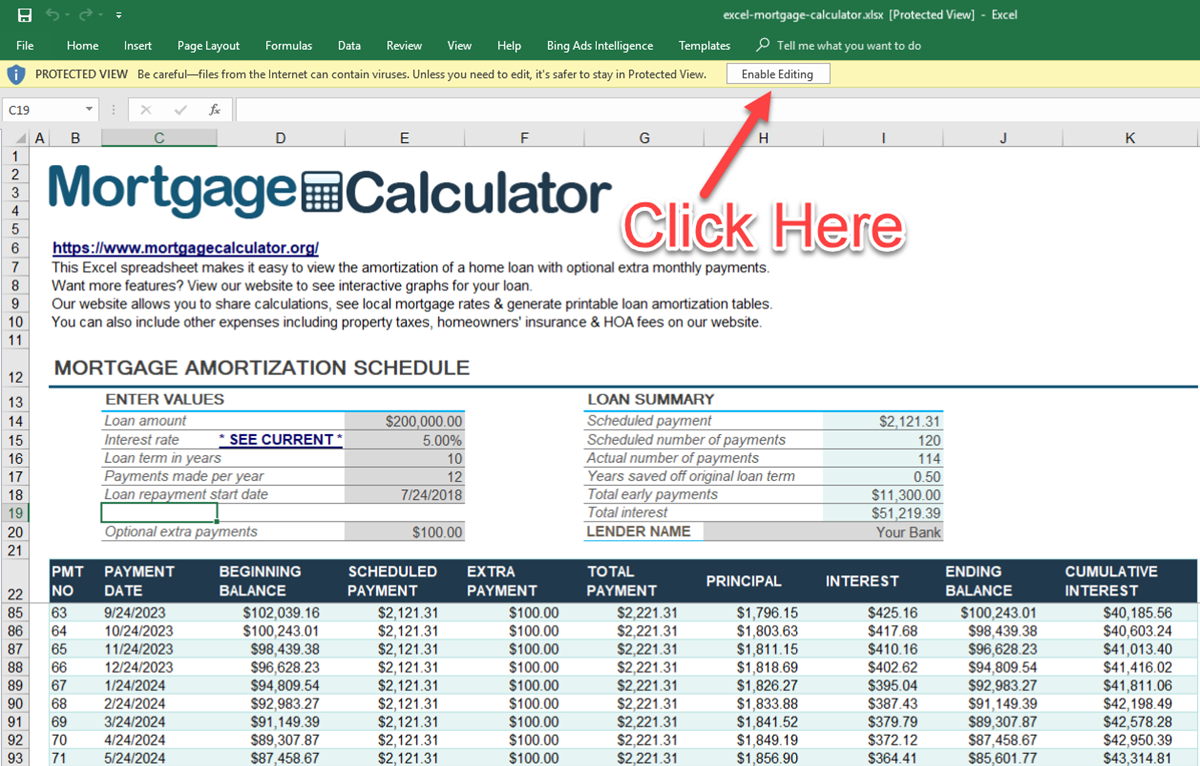

HDFC Bank's EMI calculator for a home loan can help you make an informed decision about buying a new house. The EMI calculator is useful in planning your. Use the farm or land loan calculator to determine monthly, quarterly, semiannual or annual loan payments. Get ag-friendly, farm loan rates and terms. Free mortgage calculator to find monthly payment, total home ownership cost, and amortization schedule with options for taxes, PMI, HOA, and early payoff. Keep in mind that your minimum down payment may be higher if you're buying a second home or an investment property. Click here to find lenders to discuss your. When purchasing a home, after a down payment is paid by a home-buyer, any remaining balance will be amortized as a mortgage loan that must be fulfilled by the. Use mortgage calculators to estimate monthly payments for home purchase or refinance loans. See your estimated monthly payment at loanDepot. Use our simple mortgage calculator to quickly estimate monthly payments for your new home. This free mortgage tool includes principal and interest. When purchasing a home, after a down payment is paid by a home-buyer, any remaining balance will be amortized as a mortgage loan that must be fulfilled by the. Determine what you could pay each month by using this mortgage calculator to calculate estimated monthly payments and rate options for a variety of loan. HDFC Bank's EMI calculator for a home loan can help you make an informed decision about buying a new house. The EMI calculator is useful in planning your. Use the farm or land loan calculator to determine monthly, quarterly, semiannual or annual loan payments. Get ag-friendly, farm loan rates and terms. Free mortgage calculator to find monthly payment, total home ownership cost, and amortization schedule with options for taxes, PMI, HOA, and early payoff. Keep in mind that your minimum down payment may be higher if you're buying a second home or an investment property. Click here to find lenders to discuss your. When purchasing a home, after a down payment is paid by a home-buyer, any remaining balance will be amortized as a mortgage loan that must be fulfilled by the. Use mortgage calculators to estimate monthly payments for home purchase or refinance loans. See your estimated monthly payment at loanDepot. Use our simple mortgage calculator to quickly estimate monthly payments for your new home. This free mortgage tool includes principal and interest. When purchasing a home, after a down payment is paid by a home-buyer, any remaining balance will be amortized as a mortgage loan that must be fulfilled by the. Determine what you could pay each month by using this mortgage calculator to calculate estimated monthly payments and rate options for a variety of loan.

Calculate your mortgage. Note: Calculators display default values. Enter new figures to override. Home Purchase Price. $. Down Payment %. %. Term. 10, 15, Enter a total loan amount into this auto loan calculator to estimate your Preferred Rewards members who apply for an Auto purchase or refinance loan. A mortgage calculator is a smart first step to buying a home because it breaks down a home loan into monthly house payments, based on a property's price. Need to estimate your loan payment amount? Use our easy loan calculator to quickly calculate the payment for any loan amount. Get started with TruChoice. Free auto loan calculator to determine the monthly payment and total cost of an auto loan, while accounting for sales tax, fees, trade-in value, and more. loan terms or down payments can impact your monthly payment and what it will take to pay off your car loan. Explanation of Terms. Purchase Price: It is. loan can help you purchase the perfect plot for your new home. What is a property loan calculator? Property loan calculators help you break down costs, so. Ready to purchase or improve that precious piece of real estate? Our team will work with you to secure a land loan with a competitive interest rate and terms. Use our auto loan calculator to estimate your monthly car loan payments. What additional fees will I incur from a car purchase? Other than sales tax. Mortgage Payment Calculator. To get a better sense of the total costs of buying a home, use our home mortgage calculator and figure out what your future. Free loan calculator to find the repayment plan, interest cost, and amortization schedule of conventional amortized loans, deferred payment loans. Try our free mortgage calculators to find out how much home you can afford, how much you could borrow and calculate your monthly loan payments with U.S. Home Loan EMI Calculator - SBI. Home Loan EMI calculator is a basic calculator that helps you to calculate the EMI, monthly interest and monthly reducing. loan. Learn more about business loans Borrowers can utilize microloans for everything covered under 7(a) loans except paying off existing debt or purchasing. When you're approved, the lender provides a lump sum of money to pay for the vehicle you're buying. You receive the vehicle to drive, while at the same time. What is a mortgage calculator? It's a tool to help you better understand your home financing options, whether you're purchasing a new home or refinancing your. Free loan calculator to find the repayment plan, interest cost, and amortization schedule of conventional amortized loans, deferred payment loans. Your monthly mortgage payment depends on a number of factors, like purchase price, down payment, interest rate, loan term, property taxes and insurance. Calculators; /; Mortgage Calculator. Mortgage Calculator. If you're thinking about buying a home, we can help you estimate your monthly mortgage payment. You. SmartAsset's mortgage calculator estimates your monthly mortgage payment, including your loan's Homeowners insurance is a policy you purchase from an.

5 Year Car Loan Interest Rate

Auto Loan - 5 Yr. Loan amount: $. State: California. Alabama; Alaska; Arizona That same wise shopper will look not only at the interest rate but also the. Actual interest rate will be based on overall creditworthiness. Other rates and terms may apply. Monthly loan payment example: a $25, loan at % APR for. Navy Federal offers competitive auto loan rates for new and used vehicles. See how much money you could save on new or used car financing today. 5-Year Auto Loan · Used-car loans with financing up to %** of the Kelley Blue Book or J.D. Power NADA Used Car Price Guide retail value plus tax, license, and. Car loan interest rate. The interest rate for car loans is also called the 5. 72 monthly payments of $ per $1, borrowed. Advertised APR. Example: A 5-year, fixed-rate new car loan for $49, The maximum Preferred Rewards interest rate discount on a Bank of America auto loan is %. Use our auto loan interest calculator to see what your monthly payment might look like—and how much interest you would pay over the life of the loan. Rates as low as % APR* on a 5-year loan Whether you're looking for a new or used vehicle, we make it easy to hit the road with low rates and no payments. New and Used Auto, Auto Lease Buy-outs, and Motorcycle Loans ; 4 Year Auto Loans · 48, %*, $ · %* ; 5 Year Auto Loans · 60, %*, $ · %* ; 6. Auto Loan - 5 Yr. Loan amount: $. State: California. Alabama; Alaska; Arizona That same wise shopper will look not only at the interest rate but also the. Actual interest rate will be based on overall creditworthiness. Other rates and terms may apply. Monthly loan payment example: a $25, loan at % APR for. Navy Federal offers competitive auto loan rates for new and used vehicles. See how much money you could save on new or used car financing today. 5-Year Auto Loan · Used-car loans with financing up to %** of the Kelley Blue Book or J.D. Power NADA Used Car Price Guide retail value plus tax, license, and. Car loan interest rate. The interest rate for car loans is also called the 5. 72 monthly payments of $ per $1, borrowed. Advertised APR. Example: A 5-year, fixed-rate new car loan for $49, The maximum Preferred Rewards interest rate discount on a Bank of America auto loan is %. Use our auto loan interest calculator to see what your monthly payment might look like—and how much interest you would pay over the life of the loan. Rates as low as % APR* on a 5-year loan Whether you're looking for a new or used vehicle, we make it easy to hit the road with low rates and no payments. New and Used Auto, Auto Lease Buy-outs, and Motorcycle Loans ; 4 Year Auto Loans · 48, %*, $ · %* ; 5 Year Auto Loans · 60, %*, $ · %* ; 6.

Hello, as a car dealer, the lowest auto loan interest rate I've recently seen is around % for new cars and % for used cars. However. Average Auto Loan Rates in July ; Average Auto Loan Rates for Excellent Credit · or higher, %, %, % ; Average Auto Loan Rates for Good Credit. For used year old automobiles not exceeding % LTV with terms from 6 months up to 5 years, APRs may range from % to % with monthly payments. 5-Year Car Loan Payment, $ Monthly Salary Percentage, %. Down Payment What is the average interest rate on a car loan with a credit score? As a very simple example, borrowing $32, for five years at 6% will require a payment of $ per month, with a total interest payment of $5, over. loan terms, monthly payments and annual percentage rates (APR). Auto What year is your vehicle? Vehicle year. Choose a vehicle year. Choose a. Our car payment calculator can help you estimate monthly car loan payments. Enter different down payments, terms, and interest rates into the calculator. That means a car valued at $30, today could be $15, in 5 years. If you had a five-year loan (% interest rate), at the end of 5 years of payments, you'. Average interest rates for car loans ; , , , ; New-car loan, %, %, %, %. Credit scores are a key factor when lenders are deciding whether or not to finance your car purchase, and often will determine your car loan interest rates and. In Q2 , the average interest rate for a new car was % and % for a used car, according to Experian. When it comes to auto loans, most lenders use. Car financing: · Calculate for · Total purchase price (before tax) · Monthly payment · Term in months · Interest rate. For a month loan: · The monthly payment comes out to be $ with an interest rate of percent. · With the added interest payments, you'll be paying a. Current vehicle loan rates ; Includes cars, pickup trucks, SUVs, etc. New, 60 Month (5-year) ; Includes cars, pickup trucks, SUVs, etc. New · 72 Month (6-year). Interest rates change all the time. However, an average interest rate on a car loan for people with bad credit has been %. loan cost based on vehicle price, interest rate, down payment and more year CD ratesBest 3 year CD ratesBest 5 year CD ratesCD calculator. Checking. Shop, finance and drive. Find the car and financing that's right for you. Get a fast credit decision, competitive rates with a 30 day rate lock. CONVENTIONAL AUTO LOAN MODEL YEARS: & NEWER. 3 Year (36 Month), %, $ 5 Year (60 Month), %, $ 6 Year (72 month)**, %, $ 7 Year. Refinancing options are also available to lower your interest rates and reduce current payments. Buy a Car. Buy a New or Used Car. Have. Shop around the dealer websites for specials. Toyota has rates as low as 4%, but my credit union is sitting at %. When buying your car focus.

What Insurance Companies Cover Uber Eats Drivers

State Farm offers what they call Rideshare Driver Coverage for people who drive for apps like Uber or Lyft, but according to the carrier, all you need as a. Delivery insurance for drivers who represent GrubHub, DoorDash, UberEATS and Amazon is a complex subject. Make sure you're covered. Get answers here. If you'd like to deliver with Uber Eats using a car, motorbike or scooter, you'll need a Certificate of Motor Insurance (which covers food delivery, or hire and. Basically, these insurance policies will cover the driver on a personal auto policy whenever the Ride Sharing Companies' insurance does not cover them. As. Technically, yes. If your personal auto insurance company finds out you are delivering food they will most likely deny a claim and cancel you. Basically, these insurance policies will cover the driver on a personal auto policy whenever the Ride Sharing Companies' insurance does not cover them. As. Food Delivery insurance specifically covers drivers who deliver food or parcels for a living. Standard motor insurance does not cover this type of activity. As an Uber Eats driver, you need to rely on your own personal auto insurance policy for coverage if you meet with an accident when driving. In this case, your. In March of , Uber announced that it has teamed up with certain insurance carriers to provide coverage for its drivers and riders and this differs State to. State Farm offers what they call Rideshare Driver Coverage for people who drive for apps like Uber or Lyft, but according to the carrier, all you need as a. Delivery insurance for drivers who represent GrubHub, DoorDash, UberEATS and Amazon is a complex subject. Make sure you're covered. Get answers here. If you'd like to deliver with Uber Eats using a car, motorbike or scooter, you'll need a Certificate of Motor Insurance (which covers food delivery, or hire and. Basically, these insurance policies will cover the driver on a personal auto policy whenever the Ride Sharing Companies' insurance does not cover them. As. Technically, yes. If your personal auto insurance company finds out you are delivering food they will most likely deny a claim and cancel you. Basically, these insurance policies will cover the driver on a personal auto policy whenever the Ride Sharing Companies' insurance does not cover them. As. Food Delivery insurance specifically covers drivers who deliver food or parcels for a living. Standard motor insurance does not cover this type of activity. As an Uber Eats driver, you need to rely on your own personal auto insurance policy for coverage if you meet with an accident when driving. In this case, your. In March of , Uber announced that it has teamed up with certain insurance carriers to provide coverage for its drivers and riders and this differs State to.

In reality, the coverage is actually provided to the Rideshare Driver (and Rasier, LLC, through whom Uber drivers contract) in the form of. Uber and Lyft are the most well-known rideshare companies. Both Uber or Lyft have a $1 million policy program to cover drivers if they have accidents: Driving. Uber and Uber Eats: In Ontario and Alberta, Uber provides basic commercial car insurance for its drivers and covers the drivers from when they log-on to the app. In March of , Uber announced that it has teamed up with certain insurance carriers to provide coverage for its drivers and riders and this differs State to. Uber maintains commercial auto insurance to help protect you in case of a covered accident while making a delivery on the Uber app. DP_insurance. Uber maintains some of the most comprehensive insurance for ridesharing and deliveries, including: Insurance that covers at least $1,, for property damage. Uber Eats drivers are screened and must have insurance coverage. However, in the event of an accident, their personal auto insurance often will not cover an. Uber Eats offers insurance coverage that compensates its drivers while they are online and actively making food deliveries. The additional insurance the driver. Types of Business Insurance Plans: How to Decide Which Is Right for You. By What Does Commercial General Liability (CGL) Insurance Cover? By. Andrew. So if an Uber driver caused an accident with a passenger in the car, Uber would pay for any liability claims. Then, the driver could file a claim with State. Rideshare and delivery insurance coverage is provided by Cimarron insurance company, national producer license # Insurance carrier, coverage, and service. Uber partners with top insurance companies in the US to maintain commercial Insurance coverage while driving with Uber. Image. Find out more about. Obtaining insurance as a driver with Uber is best accomplished on a Personal Auto Policy with a Rideshare/TNC (Transportation Network Company). Company (Uber Eats, GrubHub, Door Dash, Instacart, Amazon Flex), personal auto insurance policies do not cover you or your vehicle for the ownership or. Uber drivers are covered by commercial insurance through Economical Insurance car insurance provider for incidents that occur while I'm driving with Uber? There are two ways you can get insurance for delivery or rideshare services. One way is to get company-provided insurance. Uber and Uber Eats provide liability. Using your personal car as a rideshare driver Transportation Network Companies (TNCs) such as Uber or Lyft may require additional protection they don't. Uber Eats also provides personal injury protection, which covers certain medical expenses and lost earnings if you are injured while making deliveries. This can. Portier LLC is a division within Uber that manages all the delivery services for the company. · $1 million of liability coverage per incident. · Contingent. Did you know TNC stands for Transportation Network Company? These are companies that connect drivers to passengers, like Uber and Lyft. The insurance they offer.

Can I Have More Than 1 Capital One Credit Card

FAQs about Capital One's credit cards: Get the answers to our customers' most frequently asked questions about credit including credit ratings and APR. The statement credit will be provided as a single credit if the airfare purchase is greater than or equal to $ for Venture cardholders or $ for VentureOne. Some experts recommend two or three credit cards, as long as you use them responsibly. But your number ultimately depends on your personal situation. In general. In some cases, you may receive an offer to upgrade your Capital One credit card. The company also provides a customer service hotline at ON THIS. You can apply for a Capital One card online and from the comfort of your home. Once you find a card you're interested in, click the “Learn More” button next to. Most partners offer a transfer value. The value of your miles transferred this way could be worth more or less than 1 cent, depending on the cash price of. Linking your accounts means that they are grouped together under one login (same username and password). It doesn't combine or change them in any other way. For example, Citi will approve you for up to one card every eight days, and two cards every 65 days (I know, that seems random). In other words, it could be. However, there is no simple answer as to how many credit cards you should have, and there can even be advantages to having more than one credit card. Most. FAQs about Capital One's credit cards: Get the answers to our customers' most frequently asked questions about credit including credit ratings and APR. The statement credit will be provided as a single credit if the airfare purchase is greater than or equal to $ for Venture cardholders or $ for VentureOne. Some experts recommend two or three credit cards, as long as you use them responsibly. But your number ultimately depends on your personal situation. In general. In some cases, you may receive an offer to upgrade your Capital One credit card. The company also provides a customer service hotline at ON THIS. You can apply for a Capital One card online and from the comfort of your home. Once you find a card you're interested in, click the “Learn More” button next to. Most partners offer a transfer value. The value of your miles transferred this way could be worth more or less than 1 cent, depending on the cash price of. Linking your accounts means that they are grouped together under one login (same username and password). It doesn't combine or change them in any other way. For example, Citi will approve you for up to one card every eight days, and two cards every 65 days (I know, that seems random). In other words, it could be. However, there is no simple answer as to how many credit cards you should have, and there can even be advantages to having more than one credit card. Most.

Learn how banking with Capital One can help you meet your financial goals. Apply for a credit card with Capital One. Offering a range of UK Credit Cards, find the card to suit you and your needs. Discover more. does not match the information in your credit file at (or you do not have a file at) one or more consumer reporting agencies. Alerts and notifications are. credit card receivables and served more than nine million customers. The company was listed in the Standard & Poor's , and its stock price hit the $ Thinking about a second credit card? Learn how to decide if applying for a second card is right for you. By submitting a pre-approval request, you grant your permission to be evaluated for multiple Petal credit cards. Pre-approval does not guarantee an account. Apply now to get the credit card designed for union members. U.S.-based 24/7 phone customer service. $0 annual fee. Two Capital One Credit Cards Per Cardholder. Capital One limits the number of directly issued cards available for any cardholder to two. While this is a fairly. The main customer service line for Capital One credit card support is may get more credit than you initially thought. Having more. do not have a file at one or more consumer reporting agencies. Features may I am really enjoying my new credit card with Capital One and this cool app. Have questions about Capital One credit cards? Find answer in our credit card FAQ. The 2/3/4 rule: According to this rule, applicants are limited to two new cards in a day period, three new cards in a month period and four new cards in a. Travel smarter with Capital One at every step of the journey, including booking flights, hotels and rental cars. Get more from your next journey with. If you have multiple Capital One rewards cards, use the card that will get the most rewards or cash back from a particular purchase. Explore your. You probably can't. I have had two Capital One accounts over the past twenty years. One of them still has some airline miles attached to it. A Cardmember may only receive three grants of each grant type for each Union Plus Credit Card Account per their lifetime, but no more than one grant of each. Can several employees have their own card? Yes. Add unlimited employee cards to your Capital on Tap Business Credit Card account, and set individual spending. The Credit may be used in whole for a single purchase or in part over multiple purchases. Rewards will not be earned on the Credit. If the purchase using the. Apply for a credit card with capital one! It is legit a Hello, to whom it may concern I have been a subscriber of credit wise for over 6years now. Capital One VentureOne Rewards Credit Card · $0 annual fee and no foreign transaction fees · Earn a bonus of 20, miles once you spend $ on purchases within.

Tax Percentage On Ira Withdrawal

IRA stands for Individual Retirement Account. It's basically a savings account with big tax breaks, making it an ideal way to sock away cash for your. Illinois does not tax the amount of any federally taxed portion (not the gross amount) included in your Form IL, Line 1, that you received from. With a traditional IRA, withdrawals are taxed as regular income (not capital gains) based on your tax bracket in the year of the withdrawal. Roth IRA: Ability to withdraw contributions (not earnings) without incurring a 10% early withdrawal penalty. Tax Rates and Traditional vs. Roth IRAs. If tax. Therefore, your distributions are usually taxable. A Roth IRA is a little bit different. With a Roth IRA, you pay taxes on the money you add to your account. Traditional IRA. When you withdraw from a traditional IRA before age 59½, you'll pay a 10% federal penalty tax as well as tax on the withdrawal. Traditional IRA, then pay taxes on the distributions during retire- ment – at impact your tax rates and income needs during retirement. Will Social. Generally, Roth IRA withdrawals are not taxable for federal income tax purposes, if the individ- ual has had the retirement account for more than five years and. In most cases, IRA cash distributions are subject to a default 10% federal withholding rate. However, the 10% rate may not be suitable for your tax situation. IRA stands for Individual Retirement Account. It's basically a savings account with big tax breaks, making it an ideal way to sock away cash for your. Illinois does not tax the amount of any federally taxed portion (not the gross amount) included in your Form IL, Line 1, that you received from. With a traditional IRA, withdrawals are taxed as regular income (not capital gains) based on your tax bracket in the year of the withdrawal. Roth IRA: Ability to withdraw contributions (not earnings) without incurring a 10% early withdrawal penalty. Tax Rates and Traditional vs. Roth IRAs. If tax. Therefore, your distributions are usually taxable. A Roth IRA is a little bit different. With a Roth IRA, you pay taxes on the money you add to your account. Traditional IRA. When you withdraw from a traditional IRA before age 59½, you'll pay a 10% federal penalty tax as well as tax on the withdrawal. Traditional IRA, then pay taxes on the distributions during retire- ment – at impact your tax rates and income needs during retirement. Will Social. Generally, Roth IRA withdrawals are not taxable for federal income tax purposes, if the individ- ual has had the retirement account for more than five years and. In most cases, IRA cash distributions are subject to a default 10% federal withholding rate. However, the 10% rate may not be suitable for your tax situation.

Roth IRA or Roth (k) qualified distributions are tax-free. Social Security income is taxed at your ordinary income rate up to 85% of your benefits; the. Early withdrawals face a 10% penalty plus your income tax rate. Are taxes automatically taken out of a (k) withdrawal? Yes, 20% federal tax is usually. But, keep in mind that no matter your employment status or your age, the money you withdraw will be taxed as ordinary income, says the IRS. And, if you're under. How are RMDs taxed? If all your IRA contributions were tax-deductible when you made them, the full amount of the RMD will be treated as ordinary income for. IRA distributions are generally included in the recipient's gross income and taxed as ordinary income, other than qualified distributions from a Roth IRA. When you withdraw the money, both the initial investment and the gains it earned are taxed at your income tax rate when withdrawn. However, if you withdraw. If you withdraw from an IRA or (k) before age 59½, you'll be subject to an early withdrawal penalty of 10% and taxed at ordinary income tax rates. There are. Withdrawals of Roth IRA contributions are always both tax-free and penalty-free. But if you're under age 59½ and your withdrawal dips into your earnings—in. Basically, any amount you withdraw from your (k) account has taxes withheld at 20%, and if you're under age 59½, you'll be taxed an additional 10% when you. Payments from the Roth IRA that are not qualified distributions will be taxed to the extent of earnings after the rollover, including the 10% additional income. Early Withdrawal Penalties for Traditional IRAs. There is a 10% additional tax on early withdrawals from your traditional IRA. You can receive distributions. Regardless of whether you elect a withholding percentage for your IRA withdrawal, you are responsible for all federal, state, and local taxes, as well as. Withdrawals of Roth IRA contributions are always both tax-free and penalty-free. But if you're under age 59½ and your withdrawal dips into your earnings—in. What to know before taking funds from a retirement plan · Immediate and costly tax penalty. Dipping into a (k) or (b) before age 59 ½ usually results in a. Tax will be withheld on a 10% rate for non-periodic distributions. New York State and New York City Tax Exemption: Withdrawals from the NYCE IRA are. All withdrawals are % taxable, and you must include them in your taxable income for the year you take them. Subsequent distributions from your Roth IRA or Roth eligible employer account may be taxed and subject to the 10% early withdrawal penalty (see page 3) if that. IRS regulations require us to withhold federal income tax at the rate of 10 distribution(s) (excluding Roth IRA distributions) at a rate of If you can qualify for one of them, you might be able to take IRA withdrawals at a modest tax rate, at any age. One such exception covers withdrawals for higher. Once you start withdrawing from your traditional (k), your withdrawals are usually taxed as ordinary taxable income.

Easy Way Budget Plan

You'll want to select a tool to help you track your expenses. You can opt for old-fashioned pen and paper, a simple budget spreadsheet, or a budgeting app . Cancel at Any Time – You can cancel this plan at any time. Any credit owed to you or amount due to us will be reflected on your next bill. Even Easier – Many. How to create a budget in 5 steps · 1. Calculate your net income · 2. List monthly expenses · 3. Label fixed and variable expenses · 4. Determine average monthly. You must not be on a payment plan or have a history of partial or late payments. To stay enrolled in the program: Pay the exact monthly Budget Billing amount. Making a personal budget can seem overwhelming, but we've broken it down to 10 simple steps to help you take control of your finances. Plan your meals Planning your meals and sticking to a grocery list are some of the easiest ways to keep your money in your pocket. By planning what you need. It's more about long-term planning. A good budget sets aside some money for savings and paying down debt, includes enough to cover your bills, and still gives. budget is an easy and effective way of managing monthly salary. It can help you divide your income into categories that make saving easy. Add all your income together · Add all your spending together · Subtract your total spending from your total income · Any extra money is called a 'budget surplus'. You'll want to select a tool to help you track your expenses. You can opt for old-fashioned pen and paper, a simple budget spreadsheet, or a budgeting app . Cancel at Any Time – You can cancel this plan at any time. Any credit owed to you or amount due to us will be reflected on your next bill. Even Easier – Many. How to create a budget in 5 steps · 1. Calculate your net income · 2. List monthly expenses · 3. Label fixed and variable expenses · 4. Determine average monthly. You must not be on a payment plan or have a history of partial or late payments. To stay enrolled in the program: Pay the exact monthly Budget Billing amount. Making a personal budget can seem overwhelming, but we've broken it down to 10 simple steps to help you take control of your finances. Plan your meals Planning your meals and sticking to a grocery list are some of the easiest ways to keep your money in your pocket. By planning what you need. It's more about long-term planning. A good budget sets aside some money for savings and paying down debt, includes enough to cover your bills, and still gives. budget is an easy and effective way of managing monthly salary. It can help you divide your income into categories that make saving easy. Add all your income together · Add all your spending together · Subtract your total spending from your total income · Any extra money is called a 'budget surplus'.

The easiest way to start building a budget is to first understand what you're currently spending. To figure out exactly where your money is going, you'll want. This Excel template can help you track your monthly budget by income and expenses. Input your costs and income, and any difference is calculated automatically. Tampa Electric's Budget Billing program can help. It's a free and easy way to take the highs and lows out of your electric bill. The Budget Billing Plan (the “Plan”) allows you to pay your Greenville The easiest way is to enroll when you are logged into your GUC account online. So say for instance, my Easy Way is $ but I get a bill for $ I was previously signed up for autopay and it was going to take out the $ If you're a budgeting beginner, one of the easiest ways to start building out your budget is by following the 50/30/20 rule. What Is the 50/30/20 Rule? While. To get started, simply choose from 3 easy ways: Complete the form on this page and our team will contact you. Log into My Account portal. Don't have a login. A budget is a plan you write down to decide how you will spend your money each month. A budget helps you make sure you will have enough money every month. Once signed up, you'll pay a similar amount every month - making budgeting and planning much easier. Budget Billing from PNM, it's a smarter, easier way to. It's always the right time to create a saving and spending plan (aka a budget). It's also a good idea to revisit that plan annually or when a major shift. How do I ACTUALLY budget?! · Make a quick plan: $ for groceries, $80 for gas, $ for fun, $ misc/buffer - that is $ total so lets. Starting a budget can be easier than you think At its core, a budget is a way to give money a purpose. You outline how much money should go to each of your. Step 1: Set Realistic Goals · Step 2: Identify your Income and Expenses · Step 3: Separate Needs and Wants · Step 4: Design Your Budget · Step 5: Put Your Plan Into. Review your budget and check your progress every month. That will help you not only stick to your personal savings plan, but also identify and fix problems. How to do a budget to plan, save and manage your money. How to do a budget. Easy steps to plan and manage how you spend your money. Why Budgeting Is Important · Steps in the Monthly Budgeting Process · 50/30/20 Rule · Budgeting Tips · Budget Calculator · Budget Spreadsheet · Discuss Your Budget. While it won't save you money, budget billing may allow you to more easily manage your monthly budget. This budgeting plan is simply a way to make your bills. Plan for Business · Safety on the Farm · Storm Safety · Tree Trimming Automatic Payment makes things easy by automatically deducting your monthly payment. Budgeting is a powerful process that can help you develop a financial plan and build financial capability and empowerment. Five simple steps to create and use. The Budget Plan program allows you to pay about the same amount each month. Adjustments are based on your usage, weather conditions, rates for service and.

Mutual Funds Investment Definition

Mutual funds let investors pool their money together to buy stocks, bonds and other investments "mutually” to earn income or invest in long-term growth. A mutual fund is a professionally managed fund that pools lots of investors' money in order to buy a basket of investments. The basics. A mutual fund is a company that pools money from many investors and invests the money in securities such as stocks, bonds, and short-term debt. An easy way to invest in stocks and/or bonds is through mutual funds, or professionally managed portfolios. A mutual fund is an entity registered and run by an investment company or investment bank. The shareholders of a mutual fund invest money in the fund. An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group such. A mutual fund is a type of investment company, known as an open-end fund, that pools money from many investors and invests it based on specific investment goals. Finally, if you ultimately sell shares of the mutual fund at a profit, this is also a capital gain, which is taxed just as any other investment you sell at a. Mutual funds are a managed portfolio of investments that pools money together with other investors to purchase a collection of stocks, bonds. Mutual funds let investors pool their money together to buy stocks, bonds and other investments "mutually” to earn income or invest in long-term growth. A mutual fund is a professionally managed fund that pools lots of investors' money in order to buy a basket of investments. The basics. A mutual fund is a company that pools money from many investors and invests the money in securities such as stocks, bonds, and short-term debt. An easy way to invest in stocks and/or bonds is through mutual funds, or professionally managed portfolios. A mutual fund is an entity registered and run by an investment company or investment bank. The shareholders of a mutual fund invest money in the fund. An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group such. A mutual fund is a type of investment company, known as an open-end fund, that pools money from many investors and invests it based on specific investment goals. Finally, if you ultimately sell shares of the mutual fund at a profit, this is also a capital gain, which is taxed just as any other investment you sell at a. Mutual funds are a managed portfolio of investments that pools money together with other investors to purchase a collection of stocks, bonds.

A mutual fund is an investment vehicle that pools money from multiple investors to purchase a portfolio of securities. Mutual funds can invest in a wide. Mutual funds are professionally managed investment portfolios that are made up of different asset classes such as equities (ie stocks) and fixed income (ie. Mutual funds are collections of investments which are funded by investors and institutions. In this lesson, take a look at the definition of a mutual fund. Mutual funds are investment instruments that combine different instruments such as stocks or shares, bonds or both into a single product which is managed by an. A mutual fund is a pooled collection of assets that invests in stocks, bonds, and other securities. A mutual fund is a collection of investors' money that fund managers use to invest in stocks, bonds, and other securities. Mutual funds are pools of money collected from many investors for the purpose of investing in stocks, bonds, or other securities. Mutual funds are defined as a popular type of investment vehicle that pools money from many investors to invest in a variety of investment types. Definition: A mutual fund is a professionally-managed investment scheme, usually run by an asset management company that brings together a group of people. A mutual fund allows you to pool your money with other investors to buy stocks, bonds and other securities. A mutual fund is a type of investment vehicle where the money collected from various investors is pooled together to invest in different assets. What are mutual funds? The definition of a mutual fund is an investment that pools your money with that of many other people who share similar investment goals. A mutual fund is a pool of money managed by a professional Fund Manager. It is a trust that collects money from a number of investors who share a common. What is a mutual fund in simple words? A mutual fund is a pooled investment scheme where funds from multiple investors are aggregated and invested in various. Mutual funds are investment companies that pool money from many investors to purchase securities. To know how mutual funds work, Visit Us Now! A mutual fund is a professionally managed portfolio of stocks, bonds and/or other income vehicles devoted to a specific investment strategy or asset class. Mutual funds are pools of money collected from many investors for the purpose of investing in stocks, bonds, or other securities. Mutual funds are investment plans in which investors pool their money and plan their capital investment in diversified assets, often stocks and bonds. This brochure explains the basics of mutual fund and ETF investing, how each investment option works, the potential costs associated with each option, and how. Mutual funds are investment vehicles that pool money from multiple investors to purchase a collection of securities, which are managed by a portfolio.

Sc Coin

Take advantage of our flexible payment options to sell Siacoin using a variety of convenient methods including wire transfer, bank transfers and cash. Discover historical prices for SC-USD stock on Yahoo Finance. View daily, weekly or monthly format back to when Siacoin USD stock was issued. The price of Siacoin (SC) is $ today with a hour trading volume of $2,, This represents a % price increase in the last. Get the live Siacoin price today is $ USD. SC to USD price chart, predication, trading pairs, market cap & latest Siacoin news. The price of Siacoin (SC) is $ today with a hour trading volume of $1,, This represents a % price decline in the last. Siacoin (SC) Price Range 7 Days A range in which the cryptocurrency price fluctuated within 7d. Market Cap Range 7 Days A range in which the cryptocurrency. Siacoin is a blockchain service for storing personal data files on a distributed network. The main selling point of the program is that buyers looking for. Siacoin (SC) Price Today. The current Siacoin price is $ In the last 24 hours Siacoin price moved +%. The current SC to USD conversion rate is. Find Siacoin (SC) cryptocurrency prices, market news, historical data, and financial information. Make informed investment decisions with Siacoin today. Take advantage of our flexible payment options to sell Siacoin using a variety of convenient methods including wire transfer, bank transfers and cash. Discover historical prices for SC-USD stock on Yahoo Finance. View daily, weekly or monthly format back to when Siacoin USD stock was issued. The price of Siacoin (SC) is $ today with a hour trading volume of $2,, This represents a % price increase in the last. Get the live Siacoin price today is $ USD. SC to USD price chart, predication, trading pairs, market cap & latest Siacoin news. The price of Siacoin (SC) is $ today with a hour trading volume of $1,, This represents a % price decline in the last. Siacoin (SC) Price Range 7 Days A range in which the cryptocurrency price fluctuated within 7d. Market Cap Range 7 Days A range in which the cryptocurrency. Siacoin is a blockchain service for storing personal data files on a distributed network. The main selling point of the program is that buyers looking for. Siacoin (SC) Price Today. The current Siacoin price is $ In the last 24 hours Siacoin price moved +%. The current SC to USD conversion rate is. Find Siacoin (SC) cryptocurrency prices, market news, historical data, and financial information. Make informed investment decisions with Siacoin today.

Buy Siacoin (the native currency of the Sia cloud storage network) in Australia with Swyftx. Create a free trading account to Buy SC today. We provide you with multiple Siacoin exchange options so that you can choose the offer with the best rates and lowest Siacoin fees. The live Siacoin price today is $ USD with a hour trading volume of $2,, USD. We update our SC to USD price in real-time. Siacoin is down %. r/siacoin: Sia is a Decentralized Cloud Storage software solution engineered to provide privacy-focused, redundancy, and enterprise-level. Siacoin (SC) is a decentralized platform for cloud storage to compete with existing storage solutions at both the P2P (peer-to-peer) and enterprise levels. Siacoin (SC) is a decentralized platform for cloud storage to compete with existing storage solutions at both the P2P (peer-to-peer) and enterprise levels. Siacoin Price Overview. The current Siacoin price is €. The price has changed by % in the past 24 hours on trading volume of €. The. Siacoin promises to offer secured storage transactions with smart contracts which is more affordable and reliable. Moreover, it is completely open source which. The current real time Siacoin price is $, and its trading volume is $8,, in the last 24 hours. SC price has grew by % in the last day, and. Our forecasts suggest Siacoin could average $, with a low of $ and a high of $ in the next five years. Siacoin (SC) is the native cryptocurrency for the Sia blockchain platform. Siacoin serves as a way for customers to pay hosts for renting storage space. The Sia. Siacoin (SC) is a blockchain service which enables the trade of free hard drive space between users on its network. Users can sign up to rent out their. About Siacoin. The price of Siacoin (SC) is $ today, as of Sep 07 a.m., with a hour trading volume of $M. Over the last 24 hours, the. Siacoin Price Summaries. Latest Data. Siacoin's price today is US$, with a hour trading volume of $ M. SC is % in the last 24 hours. It is. Siacoin (SC) Price Today. The current Siacoin price is $ In the last 24 hours Siacoin price moved +%. The current SC to USD conversion rate is. 38 votes, 36 comments. As the title says, I've been out of the loop for 6+ years. I purchased around $k worth of Siacoin back in (no. The all-time high price of Siacoin (SC) is $ The current price of SC is down % from its all-time high. Get the latest Siacoin price, SC market cap, charts and data today. The live Siacoin price today is $ with a market cap of M and a hour. About Siacoin. The price of Siacoin (SC) is $ today, as of Sep 07 a.m., with a hour trading volume of $M. Over the last 24 hours, the. Experience fast and convenient exchange of Siacoin or any other cryptocurrency by choosing from + assets available on our service.